How to Buy Solana in 2024 – Beginner’s Guide

Last Updated on

If you’re looking for a digital currency that holds quite a lot of potential for trading in 2024, it might be worth taking a closer look into a coin like Solana. Solana (SOL) was only launched in 2020, but it has seen significant growth through 2021 and looks to continue its success onward through this year.

In fact, some even believe that Solana has the ability to rival Ethereum – which at the moment, is second to none other than Bitcoin itself. While this is just speculation of course, it’s certainly worth considering why Solana is getting so much praise and whether or not it will live up to the hype. Learn how to buy Solana coins quickly and safely below.

Table of Contents

ToggleWhere to buy Solana coin

If you’re interested in purchasing some SOL coins, you’re going to need to make sure you choose an exchange that supports this cryptocurrency. Here are a couple of examples of popular crypto trading platforms that will allow you to buy and sell Solana:

Bitcoin

Bitcoin

1 Provider that matches your filters Providers that match your filters

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

No results found

Trying adjusting the filter to see some results.

- Trade real cryptocurrencies and crypto CFDs

- Licensed broker with deposit insurance

- Integrated wallet

Cryptocurrencies are very volatile and overall a risky investment. 69% of investor accounts lose money when trading CFDs

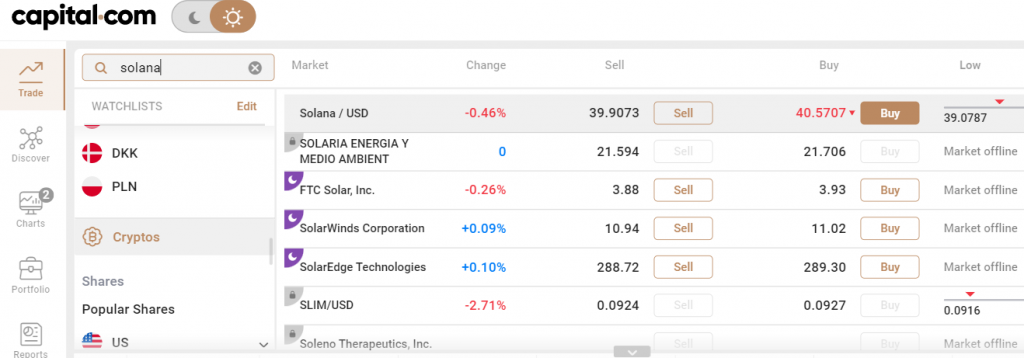

Capital.com

Another excellent exchange for buying Solana is Capital.com. Much like eToro, you’ll find that Capital.com has access to a range of cryptocurrencies and other markets to invest in, as well as FCA regulation and great security.

You’ll also get to enjoy negative balance protection, competitive spreads and plenty of educational resources to help you with getting started. However, it is worth noting that spread betting is only available to UK residents. No hidden fees and great customer support have only helped Capital.com to grow its audience further and attract all kinds of investors, new and old.

Capital.com is also an award-winning platform, utilising AI algorithms to provide its users with a simpler and more profitable trading experience. What’s not to love?

*all trading involves risk

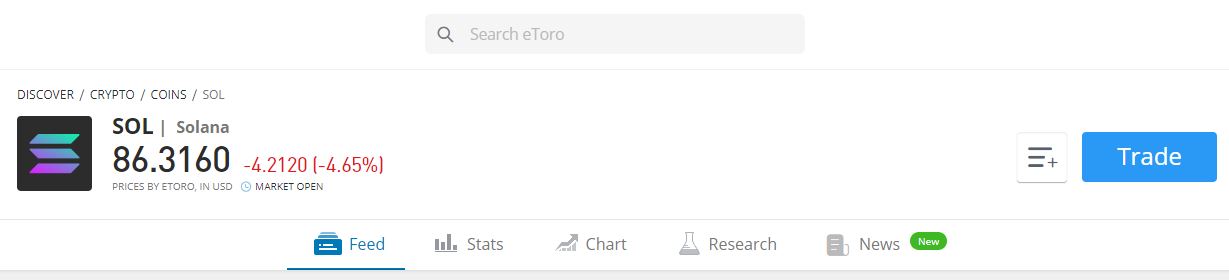

eToro

As one of the most well-known exchanges in the crypto business, it’s not hard to see why eToro is on the list. This platform supports a variety of different digital coins (as well as other assets) and you’ll be glad to hear that Solana is one of them.

Several things have helped eToro to rise to the top of the industry. For one, it’s easy to get started and doesn’t have extortionate fees. It’s also popular for being secure, as well as being regulated by the FCA. It’s beginner-friendly too, so this exchange has everything you could ask for.

As we can see from these points, eToro is a great site for a range of reasons. With all of these factors in mind, it’s worth taking this platform into consideration when searching for the ideal brokerage.

*all trading involves risk

Binance

While not usually the best choice for those who are just starting out in the world of crypto, there are a number of things that have helped Binance to become a top competitor in the market.

With a customisable interface and range of advanced features and settings, most people find Binance to be one of the industry’s most versatile and interesting exchanges. It also has several unique options too, as well as its own crypto token, Binance Coin, alongside many others (including Bitcoin, Ethereum and of course, Solana).

Coinbase

Most popular among beginners, Coinbase aims to offer a simple and straightforward trading process to all its users. Better yet, it’s generally considered to be a secure place to buy and sell crypto too, so you won’t have to worry too much about anything happening to your investments whilst using this exchange.

While it’s not quite as good if you don’t upgrade to Coinbase Pro, there are still a range of things that the free version can do for you, which is well worth taking into consideration.

Kraken

As one of the oldest cryptocurrency exchanges in the business, it’s not hard to see why Kraken is generally considered to be one of the best. Known for being a reliable option and having great services and a broad range of digital coins, like Solana, it’s generally a great choice for pretty much any crypto investor.

You’ll also find that Kraken has fairly low fees considering its popularity, which is always a nice bonus if you’re looking to make the most out of each and every investment.

Crypto.com

Last but not least we have Crypto.com – a platform that is popular for its broad range of supported cryptocurrencies, fair fees and general support for crypto on the whole. Better yet, those who hold and use CRO (the platform’s own token) will find that they can get even better fees, which could be worth taking into consideration.

Essentially, if you’re looking for an all-round good site that facilitates Solana trades, as well as many more crypto trading pairs and currencies, you’ll be interested in what Crypto.com has to offer.

Which one of these platforms is best for buying Solana?

As you can see from the 6 exchanges listed above, there are several different places where you could purchase these digital coins.

While you may find that many factors will come down to personal preference, there will always be some that can help you to decide regardless of your unique wants and needs. Here are a few of the things that you should consider when choosing your crypto trading platform:

- Security – For many people, knowing that their digital coins and personal data are protected is a must. Because of this, you should always take the time to ensure that the security of a platform is top-notch.

- Transparency – In many instances, there’s a lot that you can learn about a platform by how much it reveals about the people behind it. If there’s no information on the founders, headquarters, or team members, it’s generally a red flag.

- Availability – When you consider the fact that not all exchanges are available worldwide, it’s important to look into your options and see if they’re accessible in your area and legal to use where you are.

- Investments – There are so many cryptocurrencies and being able to pick and choose which ones you put your money into can often be a great feature. Even if you’re focused on Solana right now, don’t rule out the other possibilities.

- Fees – Most reliable exchanges are going to charge some form of fee for their services and because of this, you should always pay mind to how much you could be looking to take out of your investments for the tools you’ll be given.

*all trading involves risk

What is Solana?

The SOL coin is just a part of what the Solana project has to offer. It is focused mostly on the Solana blockchain, which aims to support crypto apps of many kinds and provide more efficient transactions to investors. While similar in many ways to Ethereum, there are also several things that set these two apart – one of the main ones is the fees associated with them (Solana being the more affordable option).

Those who are interested in everything Solana is aiming to achieve (and to profit from the success that this project could receive) will want to purchase some of their digital coins. With these tokens, you’ll be investing in Solana and therefore have the ability to earn from its prospective accomplishments.

Why is it worth investing in Solana?

Of the many different cryptocurrencies out there on the market, it’s important to ask what makes this particular option worth your time, effort and money.

The thing is, while these digital coins may hold a lot of potential, some projects don’t succeed and it’s important to ask whether or not Solana is the right investment for you. Here are just a few of the things that you should keep in mind if you’re still unsure of whether or not to buy or trade Solana:

The volatility of the currency

Looking at the growth of this coin, it’s quite clear to see that Solana has been gaining quite a bit of traction. SOL coin has increased by nearly 15,000%, but since this cryptocurrency is still relatively new and in its early days, there are still the potential risks of volatility bringing it back down. Because of this, it’s important to be aware of the pros and cons that can come with Solana, as well as looking into what other people think the future of this particular digital currency looks like.

The potential of the project

Many people look at things as an investment and how the asset is currently performing in the market, but it’s important to also consider what Solana is, what it can potentially achieve and if you feel that it has any lasting power. SOL may be a unique prospect for the future, but the same can’t be said for all crypto projects, so it’s always worth doing a little research to ensure that you’re putting your money into the right endeavours.

The predictions for the future

Alongside potential, there is also the crucial factor of price predictions. If you’re looking for a way to see what other people think will happen in the near future, it’s often worth checking out some crypto forecasts from experts. Considering some of the predictions for Solana right now, and the success that many people are waiting for, it’s not hard to see why so many people are choosing to back this project.

The trading methods you employ

If you’re experienced in crypto, you’ll know that these types of investments can come in many forms – and that the type of strategy you employ can often make a significant difference to your chances of success. From day trading, to buying and holding; it’s worth considering if your preferred style of trading will work for Solana investments.

*all trading involves risk

What’s the difference between buying and trading?

For those who are still fairly new to the world of crypto, you may be a little unsure of what the difference is between buying and trading cryptocurrency. However, knowing this will be essential if you want to make the right moves in your investments.

Usually, those who are buying Solana will want to buy and hold, and usually will only really need to make one purchase. You can do this through most crypto exchanges and crypto wallets – and you won’t have to worry too much about the complications of fluctuating prices and being inactive in the market.

On the other hand, trading requires you to be involved at the moment, so you will often have to be aware of everything that’s happening in the world of crypto. You’ll also need to be more considerate of trading fees too, as well as look out for any tools that could potentially improve your trading experience. You can generally both buy and trade on the crypto exchanges listed earlier, so you can feel free to make a selection that will meet your requirements, even if some of them are better suited to more active trading.

How to buy Solana (SOL)?

Usually, you’ll find that the process of getting your hands on some of these digital coins won’t be too much of a challenge. In fact, here are 4 simple steps to purchasing Solana:

Create an account on an exchange

If you’ve chosen the right platform for your unique needs, the first step is to register with them. This will usually require your first and last name, phone number, email address and a password at the very least. Even with verification, the whole process shouldn’t take too long at all.

Make your first deposit

Usually, you’ll find that putting some money into your account is incredibly easy, too. While each platform is different, there will usually be a clear place to go for making deposits (look for a dedicated page or button). Most exchanges will have their own minimum requirement and will support different payment methods, which may be worth considering before you sign up.

Purchase your SOL coins

If it’s Solana that you’re interested in, all you need to do is select the option to buy these digital coins and you should be able to get started with trading. Of course, this is only an option if the platform you choose facilitates this particular currency, so always be sure to check first.

Store your Solana

If the platform doesn’t have its own wallet, it’s probably worth finding one that accepts Solana and connecting that hardware wallet to your exchange. This way, you can keep them safe and secure outside of the trading space. If you don’t plan on trading regularly, this can be an even more crucial step for additional security, so be sure to keep this in mind.

Final thoughts

With all this in mind, we hope that you have a better understanding of what Solana is, which platforms you could buy it on and most importantly, whether or not it’s going to be worthwhile. In any situation, it’s always best to take the time to do your research. You should always consider the prospects of the project and whether or not it’s likely to survive in the long term.

From the exchanges you’re interested in, to details on the cryptocurrency itself, there is often a range of things that can be good to know before you jump into any big decisions.

*all trading involves risk

Frequently asked questions about Solana

Is Solana better than Ethereum?

Looking into how both of these projects and their currencies function, you’ll find that Solana is fairly similar in quite a few ways. On the other hand, there are some key differences between the two. Solana does have a higher capacity than its rival, being able to handle as much as 50,000 trades per second, which is just one of the ways that Solana is pushing to improve on the concept of Ethereum. While Ethereum may be a reliable option, there’s no doubt that Solana is increasing in popularity at a rapid pace and that’s something worth taking into consideration.

How much are transaction fees on Solana?

Solana is not only fast, but also generally quite cost-effective, too. Most users will find that its fees are exceptionally low, usually being as little as $0.00025 on each transaction. So, if you’re looking for an opportunity to enjoy more efficient and cheaper transactions, it might be worth taking advantage of everything that Solana is aiming to provide.

How does Solana verify transactions?

In general, the way verification works on Solana is through signatures of confirmed transactions. Essentially, each time a transaction is made, the validators take and store these signatures for a short period of time to make sure that they’re only processed one time. Overall, it’s a simple and efficient process that allows for a smooth and cost-effective trade.

Are SOL coins a good investment?

Despite the promise that Solana holds for the future, you should consider that it’s still fairly new and that you may be able to learn more about it if you wait until the project is more developed. However, you could end up getting yourself better prices by buying now. The best thing you can do is take the time to carefully consider your options to make the right decision.