That is one way to ensure consistent returns through any upheavals in the market. This is where an ETF or Exchange Traded Fund comes into the picture. If you are new to ETF, then read on to learn more about everything related to ETF brokers.

List of the best ETF brokers

Those in the United Kingdom have quite a few different options to choose from, meaning that getting started in exchange traded funds shouldn’t be too much of a hassle.

1

Payment methods

Features

Customer service

Classification

Mobile App

Fixed commissions per operation

Account Fee

- No fees for deposits and withdrawals

- Support over 20 local numbers

- Minimum deposit only $20

CFDs are complex instruments and carry a high risk of losing money quickly through leverage. 72.6% of retail investor accounts lose money when trading CFDs from this provider.

Account Info

Fees per operation

Here are your top 3 options:

eToro

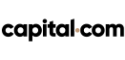

There are plenty of individuals who choose eToro for their ETF trading needs, as well as for several other types of investments; from stocks, to crypto. There are a host of reasons why it might be worth choosing eToro for ETF investments – and this is evident from the significant number of traders who use this platform not just in the UK, but in many other places around the globe.

Looking specifically into what eToro has to offer for ETF trading, you’ll see plenty of things that make this site appealing, such as the fact that there are no commission fees charged on exchange traded funds for UK and European users. The minimum investment amount is also low too, which makes it even easier for virtually anyone to get started without having to worry too much about costs or having to invest larger amounts into something they’re not quite confident in yet.

eToro – A broker you can trust

Of course, the fact that eToro is such a big name in the business is another important thing to consider. Thanks to its notoriety, you can rely on this platform to be both reputable and reliable; after all, if it wasn’t, it wouldn’t be one of the first recommendations from multiple sources. With this in mind, you’ll generally be able to relax knowing that you’re using a website you can trust.

Other factors like a user-friendly site and plenty of features that make life as an investor easy only serve to make eToro an even better choice.

Overall, if you want to use a good platform that makes ETF trading simple (and perhaps even try investing in other assets down the road), coupled with low costs and a brand that stands above the rest; it’s worth giving eToro a try.

*all trading involves risk

Capital.com

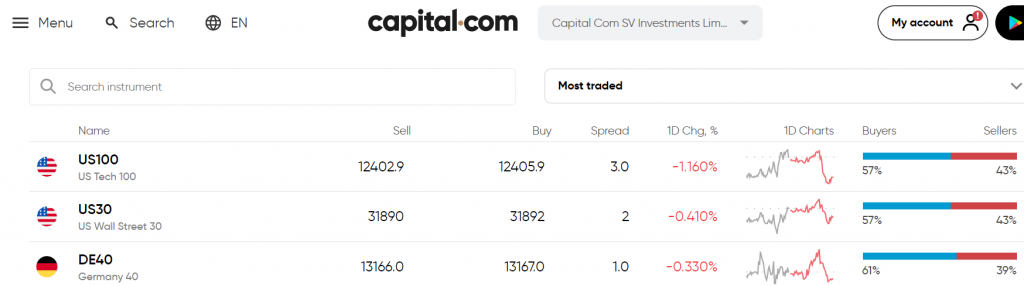

Another excellent option available to those in the UK is Capital.com, a website that many people use for the variety of tools and features on offer. When using Capital.com for ETF trading, you’ll have access to things like all-around trading analysis, an AI-based News Feed and even the ability to create a demo account to both test out and get familiar with everything the site provides.

Taking a closer look into the News Feed, this particular tool will give you access to a wide range of resources, from articles to videos, to help provide worthwhile information that could assist you in making your investments (if you use it wisely). Thanks to the AI software that Capital uses, the News Feed is typically able to provide users with the content that’s most suitable for them, so if you’re more focused on ETFs you’re likely to see much more relevant data as you spend time on the site than other platforms are likely to provide.

What else is on offer at Capital.com?

There are many more things that make Capital.com a worthwhile choice. For example, this platform makes it easier to invest in the most popular ETFs around, even if you don’t have an extensive amount of funds to work with. You can even trade ETFs with CFDs and have access to a variety of different assets. The high-end security and licensing from the CySEC, FCA and NBRB ensure that you, the user, are protected while on the website – and this level of safety shouldn’t be overlooked.

As you can see, there are quite a few reasons why this particular trading platform can be an excellent choice for a wide variety of investors.

Interactive Brokers

Last but not least is Interactive Brokers, a platform that offers a large range of ETFs for their users to invest in, as well as much more to entice traders from around the globe.

As you would expect from a popular platform, this site is secure while being easy to use, making it the perfect choice for beginners and experts alike. One of the things to catch the attention of new investors is the ability to trade with over 13,000 ETFs, which is certainly an impressive amount. Overall, it’s well worth looking into for this alone.

Other Popular ETF Brokers

If you are looking for a broker to help you in trading ETFs, look at the list here. These are the best ETF brokers and quite well known for their excellent track record.

- Charles Schwab. This firm remains at the top of most lists when it comes to ETF brokers. It offers a simple and modern style of investing. They are well known for helping individual investors reach their full potential. It not only makes trading accessible to all but also offers more than 245 commission-free ETFs to choose from.

- ETrade. This firm provides easy-to-use tools and advanced platforms for investors to trade on. They offer commission-free stocks, options, mutual funds, apart from the ETFs. So, it can be a one-stop shop for your financial investments. You get a valuable ETF knowledge section that provides a lot of guidance and quality research.

- TD Ameritrade. Another broker firm that offers a great trading experience to investors. It provides mind-boggling 2300+ commission-free ETFs. You also get the right tools and research to understand the process better. It caters to both new and experienced ETF investors and gives a complete ETF investment experience.

What is an ETF?

How do you decide to buy a stock? You look at the performance and analyze it to decide if it is worth investing in the stock. What if you did not have time to do so? An ideal way to invest would be to invest in an ETF. You can define it as a basket of securities with its shares being sold on an exchange. It is different from Mutual Funds in two major ways:

- ETF shares are traded throughout the day via platforms like ETF brokers UK, unlike mutual funds.

- ETFs are managed passively while mutual funds are actively managed.

ETFs are a great way to invest because they offer the best of both asset classes, the diversification benefits of mutual funds, and the ease of trading in stocks.

For any investor, buying ETFs is an easy and alternate way to buy individual stocks without extensive research. ETFs are bundles of stocks and you can buy a part of. If an ETF has 30 stocks, you can buy 5% of that ETF, which means you would be the owner of 5% of all the stocks in the ETF. This is what makes ETFs so popular and are part of many portfolios.

How do ETFs work?

The fund provider owns the assets, which are the stocks. The fund manager will design the fund to track the performance of the stocks and then sell shares of the fund to investors. Even if an investor does not own the underlying assets, they still share dividend payments or reinvestments. These steps can explain the workings of an ETF more simply.

- The first step is creating a basket with a variety of assets such as stocks, bonds,

- currencies, or commodities.

- Now it is offered to investors, and they can buy shares of this fund.

- The fund is traded on an exchange throughout the day, and buyers and sellers trade their share of the fund.

For investors who want the high returns of the stock exchange but do not want to risk the possibility of stocks going downside, ETFs present a unique opportunity.

*all trading involves risk

ETF and Brokerage

Can you invest in ETFs directly? Unfortunately, that is not possible. ETFs are sold and bought on the secondary financial markets. If you decide to invest in ETFs, you will need to open a brokerage account. There are big and small brokerage companies offering ETF investing options. The options are so many that they can confuse you. Here are a few tips which can help you before starting to trade in ETFs.

- Commission: many ETF brokers offer free trading or charge very low trading commissions. Look at any hidden charges that can increase the overall cost.

- ETF selection: some brokerages offer between 150 and 200 ETFs to choose from. The bigger the variety, the better it is for investors.

- Research: the brokerage firms should offer enough data about the ETF they are offering. Specific information about the origin, strategy, aims, and past performance must be easily available to the investors.

- Compare: compare the past performance of similar, competing ETFs to get a better idea. A proven track record of at least 3 years of good performance should be a good indication.

- Level Of Liquidity: you need to make sure that the fund you choose has a high level of liquidity. The actual volume of trading will give you a good indication of how liquid the fund is.

How do you trade ETFs?

Like we mentioned earlier, trading ETFs directly is not possible. Investors can trade either through traditional brokers or through online brokers. You can also day trade ETFs, and many of them are as liquid as stocks. Because ETFs are traded like stocks, they can also be shorted. When a trader sells borrowed shares intending to buy them when available at a cheaper rate, it is known as short selling.

ETFs also payout dividends attached to the stocks in their basket. Usually, quarterly payments of the dividends are made to the investors. Not all dividend-based funds are equal. The difference between funds can be huge. So, it is essential to understand fully before choosing any ETF .

Conclusion

There is no one-size-fits-all solution to finding the perfect ETF broker. Even a low-risk investment option like ETF can seem complex to many. It mainly depends on your circumstances and what your priorities are. If you want to invest in ETFs, you will need a broker who can guide you, and help you reap benefits.

*all trading involves risk

FAQ

What are ETFs in simple terms?

Short for exchange-traded funds, ETFs are a form of security. These track an index, commodity and other types of assets, and can be bought and sold on trading platforms (like the ones listed above). Essentially, it’s a collection of stocks or bonds and they’re often considered to be an excellent choice for new investors thanks to their low fees, the wide range of options, liquidity and much more. Additionally, exchange-traded funds can also contain multiple types of investments, as well as a mixture of different types all in one. With so many uses and a level of reliability that other trading options may not provide, they can certainly be a solid choice.

Why are ETFs so popular?

Considering some of the points made above on why these are usually good for beginners, it's plain to see why so many people are interested in ETF trading. The fact that they can often be inexpensive, offer diversity in assets and more aren’t just benefits that are exclusive to those starting out, however. Even those who consider themselves to be more seasoned investors can take advantage of the many features and benefits that an ETF has to offer. In fact, things like high liquidity and adding to a diversified portfolio are things that more experienced investors are likely to find attractive since they’ll usually have a better understanding of what these mean and how to make the most of them.

Are ETFs better than stocks?

While both have their advantages, there’s no doubt that there are a few things that can make exchange-traded funds a more appealing option than stocks when compared against each other. As an example, most consider ETFs to be a safer investment (although it is still worth considering that both come with their own risks). There are certainly a few situations where you might find ETFs to be the best solution when trading, but it’s always worth taking the time to consider your options if you want to ensure that you’re making the right choice for your investments.

How are ETFs different from mutual funds?

While similar in many ways, some things set ETFs apart from mutual funds. For starters, these are traded on the stock market and can therefore be sold and bought just like regular stocks, which certainly has its advantages. For example, you can trade them at any time during the working day, where mutual funds are priced at the end of the trading session. Small things like this can certainly help to make ETFs more appealing, especially for beginners who are eager to get their investments up and running and want to feel productive in their endeavours.

What types of ETFs are there?

If you’re looking closer into your ETF investment opportunities, you might notice that there are many forms of exchange-traded funds to choose from. These include GLD (SPDR Gold ETF, which tracks gold’s performance as an asset), XLL (Technology Select Sector SPDR ETF, which provides investors with exposure to tech companies in the United States), and more. If you want your investments to do their absolute best for you, it might be worth taking a closer look into what these types of ETF assets have to offer.

Should you invest in leveraged or inverse ETFs?

Generally speaking, leveraged ETFs provide a higher return (often two or three times the daily performance) on benchmark indexes. On the other hand, inverse ETFs provide the opposite of the benchmark index, offering a rise when the index falls and vice versa. The choice is generally up to you, but it’s important to consider the risks and potential rewards that each has. If indexes drop, inverse ETFs will be the best option, whereas if they rise, you’re going to want to have leveraged ETFs instead.

Can ETFs be taxed?

While you might need to pay tax on your exchange-traded funds in the UK, it isn’t usually going to be too much of a problem. You could, for example, store your bond ETFs in an ISA or SIPP account first. ETF traders are exempt from Stamp Duty in most jurisdictions too, which is another bonus that you might want to keep in mind. In any case, it’s best to talk with a financial expert like a tax planner to find the best solution, so that each and every investment you make has the potential to perform at its best.