Crypto Investing: How-to guide for Beginners for 2024

Last Updated on

Are you a crypto beginner looking for information on how to invest in bitcoin and other digital assets? No doubt, investing in cryptocurrency can make you filthy rich. However, there is also a chance that you could lose all your money as the market is highly volatile.

Knowing how to invest and where to invest can help you reduce your risk and increase your chances of making a high profit. As a beginner, it is also crucial to keep yourself abreast of the main strategies and tips for investing in cryptocurrency.

Here, you will learn about the best platforms to invest in cryptocurrencies and how to get the most out of them. Additionally, you will uncover the pros and cons of each platform so you can choose the right app. This post will also walk you through practical strategies you can use to maximize your cryptocurrency investment and limit your risk exposure. In addition, we shared some factors to consider before you start investing in digital assets.

Let’s get started with a list of the best platforms you can leverage to make money from cryptocurrency.

Table of Contents

ToggleHow to invest in crypto: best platforms

Do you want to invest in cryptocurrencies but don’t know where to start? Below are the top five best crypto exchanges and investing platforms in 2024. These platforms offer high returns on your investment and charge the lowest fees in the market. Furthermore, they are user-friendly, making them suitable for beginners. Our top five crypto investing platforms are:

Bitcoin

Bitcoin

1 Provider that matches your filters Providers that match your filters

Payment methods

Features

Usability

Support

Rates

Security

Selection of Coins

Classification

No results found

Trying adjusting the filter to see some results.

- Trade real cryptocurrencies and crypto CFDs

- Licensed broker with deposit insurance

- Integrated wallet

Cryptocurrencies are very volatile and overall a risky investment. 69% of investor accounts lose money when trading CFDs

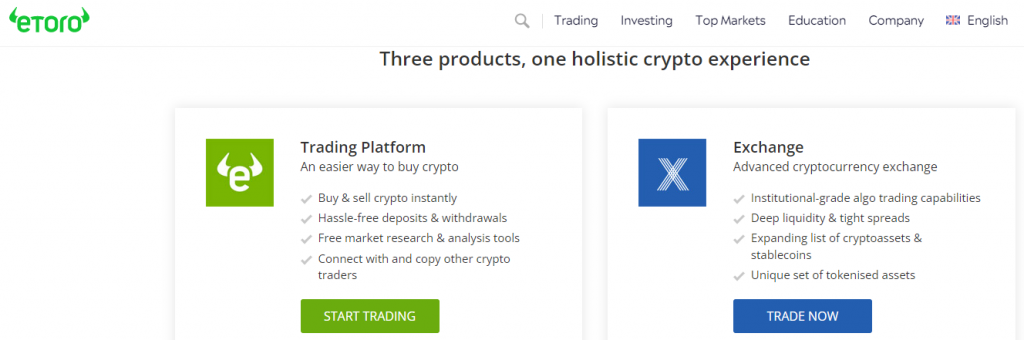

eToro

eToro is one of the best global cryptocurrency trading platforms you can leverage to make money in 2024. The platform offers users a variety of ways to earn regular profits and grow their wealth. One of these options is the eToro staking program. Here, you earn steady passive income by keeping your crypto assets on the platform. Like you earn interest on your money when you keep it in a bank, eToro also gives you rewards when you keep your digital assets with them.

Depending on the coin you stake and your membership level on eToro, you can earn between 75% to 90% of the monthly staking yield. This reward percentage is presently one of the highest you can get in the crypto market. We also like eToro because it charges the lowest fees in the crypto space. Compared to other platforms, eToro’s fees are relatively lower as the company only retains a small portion of the reward you get to cover its operational, technical, and legal costs.

Another way to make money is by using eToro’s CopyTrader feature. This tool allows you to choose a popular trader you like and start copying their trading pattern. The good thing here is that the system does the job for you. So all you have to do is choose the trader, allocate the money you want to use for CopyTrading, and sit back to watch the system make money for you.

*all trading involves risk

Huobi

Huobi is another great platform to consider if you are looking at getting high returns from your crypto investment while also keeping your risk to the minimum. Huobi offers a staking program that lets you earn passive income on your cryptocurrencies by holding them on its platform. So rather than allowing your coins to sit down idle in your wallet, you can move them to Huobi to earn interest.

The annual staking yield on Huobi ranges from 3% to 20%, depending on the coin you are holding on the platform. Our experts recommend Huobi because the company’s fees are low, and you can redeem your stake at any time. In addition, the platform is easy to use. Any dick, tom, and harry that can operate a smartphone would be able to invest and make money from crypto assets using Huobi.

Crypto.com

Crypto.com offers investors the most extensive number of tokens and stable coins. Although the returns you get on your crypto holding are lower compared to what Huobi and eToro are offering, it is still relatively competitive compared to other platforms. When you store your tokens or stable coins on crypto.com, you can earn about 3% to 12.5% return annually. For instance, you can earn 4% on Bitcoin and 8% on USD Coin annually.

One of the top reasons we like crypto.com is its security. There are several layers of security to protect their users’ data and funds from cyberattacks. In addition, crypto.com fees are low. Therefore, you won’t be losing a bulk of your rewards to fees when you use this platform. Lastly, you are not restricted to a few tokens or stable coins when using crypto.com.

Binance

Binance is the way to go if you are looking for staking platforms that offer investors many options. With Binance, you can decide whether to opt for flexible staking or locked staking. When you choose the former, you get smaller rewards but can withdraw your stakes anytime. However, locked stakes offer a higher reward, but the drawback is that you have to lock your digital assets on the platform for a specific period, usually 30, 60, 90, or 120 days

The estimated annual return when you stake on Binance ranges from 3.78% to 25% for stable coins and some popular tokens. You may get a higher yield on the platform if staking a less stable coin and opting for a longer lock period. Aside from being a popular crypto platform, Binance is on our list because it is easy to use for beginners and offers a decent selection of digital assets.

Coinbase

Our list of top five platforms for investing in cryptocurrencies won’t be complete without mentioning Coinbase, one of the most famous names in the industry. When you invest your digital assets on this platform, you earn about a 5% return on your investment annually. What’s more, the more assets you hold on Coinbase, the higher the APY you get and the more money you make.

Coinbase is one of the easiest platforms beginners can use to invest. With just a few clicks, you can stake on Coinbase and start earning rewards on your crypto assets. Also, Coinbase charges low fees on your staking transactions. However, the drawback with Coinbase is that it offers fewer altcoins compared to Binance and some other crypto platforms.

How to invest in crypto: strategies and tips

Below are some strategies and tips that can help you start your journey to the crypto world on the right foot. We recommend following these strategies to avoid beating yourself for investing in digital assets.

Have an investment strategy

Don’t jump at cryptocurrencies because people are doing it. Before you get started, ask yourself questions like which digital assets do I want to buy and why? What’s the best way to grow my crypto holdings? Do I want to buy and sell, stake my assets to get returns, or use an auto trader? Having a plan will give you a good start.

Manage your risk

The crypto market is very volatile, so it is not predictable. Investing in crypto can take you from rag to riches, and it can also make you lose all your investment. So the best way is to be prepared for the worst-case scenario by not investing more than the amount you can afford to lose.

Always perform market research before investing

There are many sharks out there waiting to run off with your money. The responsibility lies on you to critically investigate any platform before investing your hard-earned money with them. Our list above is a good place to start investing and making constant income from cryptocurrencies if you are a beginner.

Avoid placing all your digital assets in one basket

It is common wisdom that putting all your assets in one investment isn’t wise. This knowledge is also applicable to cryptocurrencies. Diversification is the key to maximizing your returns and minimizing your risk. So we recommend starting with at least two or three of the platforms we mentioned above to maximize your gains. In addition, invest in multiple coins, don’t put all your money into one digital asset.

Keep yourself abreast of the market trend

Staying on top of the trends in the market will help you avoid investing against the market. For example, you don’t want to buy coins when the prices are falling continuously or sell your assets when the market is at its lowest. Keeping up with crypto trends can help you make the right investment decision.

*all trading involves risk

Factors to consider before investing in cryptocurrencies

As a new crypto investor, you should consider some factors before putting your hard-earned money into cryptocurrencies. Some of the basic factors are:

-

Decide on the currencies you want

The first step is to research the market, check several coins, and decide on the best ones to park your hard-earned money on. Additionally, don’t put all your money in one basket. Instead, diversify by buying different currencies and investing in multiple platforms.

-

How much do you want to invest in crypto

The amount you invest is another critical factor to consider. As stated earlier, the market is volatile, so you shouldn’t put in more money than you can avoid losing. Don’t be tempted to invest the money you need to meet essential needs like rent, school fees, food, and others in crypto.

-

Determine your risk level

Your risk level will determine how much exposure you can tolerate. We recommend adopting strategies like investing in auto traders or crypto platforms that offer staking programs if you want less risk. This way, you earn returns on your investment without exposing your assets to the risks associated with trading or staking coins yourself.

Pros and cons of investing in cryptocurrencies

Cryptocurrencies have good sides as well as drawbacks. Understanding its advantages and disadvantages can help you decide whether it is the right investment option for you or not.

Pros of investing in cryptocurrencies

- You can earn high profits from the volatility of cryptocurrencies.

- Cryptocurrency networks are very secure, so your funds are safe from fraud and cyberattacks if you invest on the right platform.

- You won’t have to worry about the effect of inflation when you invest in digital assets.

- Crypto transactions are cheaper and faster. For example, you can send funds across international borders in a few seconds.

- Cryptos are decentralized currencies. They are not issued or managed by the government, so you get more privacy and freedom.

Cons of investing in cryptocurrencies

- Like you can make huge profits from the volatility of cryptocurrencies, you can also lose all your money to it.

- There are plenty of scammers in the cryptocurrency space. So we advise that you perform due diligence before investing in any crypto platform. Better still, start with two or three out of the reputable apps listed above.

*all trading involves risk

Frequently asked questions

What’s the best crypto platform for beginners?

The best crypto apps for beginners looking to invest in bitcoin and other digital currencies are eToro, Huobi, Crypto.com, Binance, and Coinbase. These platforms, esp. the first two, offer investors the highest returns on their investment.

Is investing in cryptocurrencies profitable?

Yes, investing in cryptocurrencies can be profitable. You can make profits from the volatility of crypto prices. However, you can also lose money to this volatility.

How can I invest in cryptocurrencies?

There are numerous ways to invest in digital assets. First, you can buy and hold digital assets in your wallets until their prices increase. Second, you can trade cryptocurrencies to make money. Third, rather than purchase and keep coins in your wallet, you can invest them in some of the platforms we listed above to start earning steady passive income. This way, you are keeping your assets safe while earning returns on them.

How much should I invest in crypto?

We recommend investing only an amount you can afford to lose. Though crypto can make you very rich, it can also make you poorer. It is a high-risk, high-return investment. However, investing in trusted crypto platforms like eToro, Huobi, Crypto.com, Binance, and Coinbase can reduce your risk exposure.