Best ICOs to Invest in 2024: Top 10

Crypto ICOs turned out to be one of the best investments in 2024, as several people who chose the right projects made significant returns. Some ICOs raised millions of dollars and earned early investors remarkable profits. Due to this outstanding performance, several crypto traders and investors are looking ahead to see what this market has to offer in 2024.

Are you considering taking advantage of upcoming ICOs to make money and grow your wealth but don’t know how to get started? Then, this article is for you. Our experts scoured the market and examined several high-profile crypto projects to bring you those that may perform well in 2024.

In addition, we’ll walk you through what ICO means, how it works, and where to find the best upcoming ICOs. We will also go over some of the factors we considered in making our pick. Later in the article, we will share some benefits of investing in crypto ICOs and answer some frequently asked questions we get about them. Let’s get started!

Best upcoming ICO and Presales to Watch Out For

Below is a quick look at our list of the best upcoming ICOs for crypto investors in 2024. We handpicked these projects after thorough research and analysis, and we believe they have fantastic potential. The next section of this article will provide detailed information about these ICOs, including why we think they are exceptional.

- Bitcoin ETF Token – cryptocurrency linked to the potential launch of the first Bitcoin ETF

- Bitcoin Minetrix – stake-to-mine token, that has achieved rapid success by raising over $950,000 in under two weeks.

- Wall Street Memes – meme coin related to the 2021 GameStop bull run

- XRP20 – an ERC-20 variant of the renowned digital asset with an added staking functionality

- IMPT – upcoming ICO project aimed at protecting the planet

- WeSendit – innovative file transfer platform

- Tamadoge – one of the world’s top meme coin

- Kyrptview – leading research-to-earn platform

- Battle Infinity – popular play-to-earn fantasy game

- Oryen Network – a robust high-yield platform for crypto investors

1. BTC ETF – token capitalizing on the anticipation surrounding Bitcoin ETF

Bitcoin ETF Token is a cutting-edge cryptocurrency linked to the potential launch of the first US Bitcoin ETF. Its unique feature involves a token burn tied to key milestones in the ETF rollout, removing 5% of the total supply each time.

Key Points for Investors in the Bitcoin ETF Token Presale:

- $BTCETF is a groundbreaking crypto with a burn mechanism tied to significant ETF milestones.

- The plan is to burn 25% of the total token supply across five milestones, concluding at Bitcoin’s $100,000 value.

- $BTCETF is available for presale at $0.0050 during Stage 1, surpassing $35,000 in the first 24 hours, with a $5 million hard cap.

Investors are attracted by the presale’s potential for significant returns, with a 36% gain for early participants. Additionally, the unique sell tax discourages immediate sales, likely creating a demand surge during launch.

In the long term, $BTCETF supply will decrease due to the sell tax, burns, and milestone events related to Bitcoin ETF development, boosting demand and driving up the token’s price.

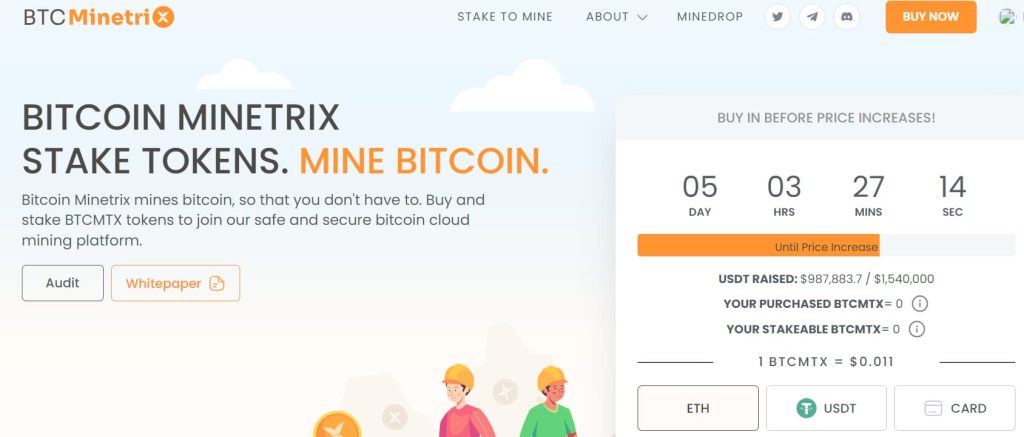

2. Bitcoin Minetrix – Innovative Staking and Cloud-Mining Platform

Bitcoin Minetrix is an innovative decentralized cloud mining platform tailored to empower everyday investors. It allows you to harness computational power for Bitcoin mining rewards without the hassles and costs associated with managing a mining farm.

Back in the early days of Bitcoin, mining was a relatively simple endeavor, where enthusiasts could mine tokens using standard computers. Notably, Laszlo Hanyecz, famous for exchanging 10,000 BTC for two large pizzas, mined his tokens using a basic GPU, which outperformed a CPU.

However, as Bitcoin transactions proliferated, mining evolved into a far more intricate process. A study from 2015, when Bitcoin’s network difficulty was significantly lower than today, estimated that it would take a standard CPU “several hundred thousand years” to mine a new block.

This escalating complexity led to the mining industry’s transformation, with large corporations dominating the scene through ASIC-based mining farms and dedicated energy facilities, making it unattainable for the average individual.

Bitcoin Minetrix (BTCMTX) provides an opportunity for everyday investors to enter the world of cloud-based Bitcoin mining transparently. The project not only offers exceptional staking APY rewards but also includes earnings from BTC mining. The core concept of Bitcoin Minetrix is the stake-to-mine mechanism, enabling investors to stake BTCMTX to earn Mining Credits. These non-transferrable Mining Credits can be redeemed for mining time on the cloud-based platform, allowing users to determine their desired Bitcoin mining hash rate based on the number of Mining Credits earned.

This approach guarantees that users maintain full control of their funds at every step of the process. BTCMTX tokens can be unstaked and traded at any time, offering unparalleled flexibility. Plus, there’s no need for investors to make deposits for securing mining contracts, as hash power is obtained through the simple act of burning Mining Credits.

Currently, the token is available in the presale at $0.011, giving investors a ground-floor entry point.

Bitcoin Minetrix Pros:

- Democratizing the once-exclusive cloud mining sector, rife with scams, using smart contracts to usher in a new era of transparency.

- Bitcoin Minetrix has the potential to revolutionize the cloud mining sector, notorious for its scam-ridden history.

- The entire process, including earnings management, is seamlessly automated through the Bitcoin Minetrix smart contract, ensuring complete transparency.

- Stakers are currently reaping impressive returns with a 1,100% APY for staking their BTCMTX tokens, in addition to the Mining Credits

- Bitcoin Minetrix has undergone meticulous auditing by Coinsult, a respected name in the security industry

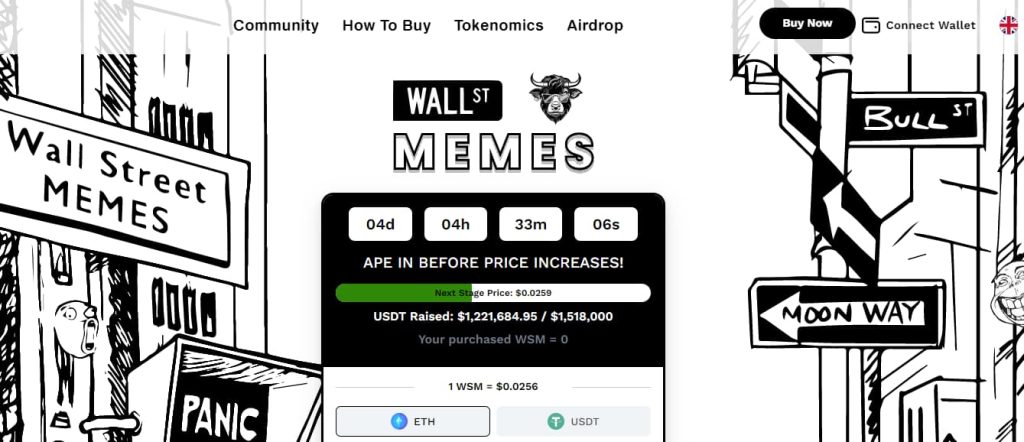

3. Wall Street Memes – Promising Crypto Taking its Roots in the GameStop Movement

Wall Street Memes is a new cryptocurrency launched in a presale by the creators of the 2021 Wall St Bulls NFT collection. The NFT collection sold out within 32 minutes, earning the founders $2.5 million. Following the NFT launch, the team continued to stay in the public eye by sharing memes related to cryptocurrency and stocks on various social media platforms. Presently, the project has gained over one million followers and has received attention and endorsements from notable figures like Elon Musk.

The Wall Street Memes token has already raised over $900K, demonstrating the strength and interest of its online community. According to the Wall Street Memes website, the purpose of the coin is to “tokenize the movement.” This refers to the Wall Street Bets movement, where millions of retail traders united to squeeze institutional investors through short-selling, ultimately outperforming them.

The Wall Street Memes token aims to recreate this historical event by enabling its community to profit from seemingly worthless meme coins. Following the principles of Wall Street Bets, 100% of the newly issued presale coins will be distributed to the community, with none being held back for the team. Half of the $WSM will be sold during the presale, while the remaining portion will be allocated for community rewards and exchange liquidity.

The initial community rewards event has already commenced, offering an airdrop of $50K worth of $WSM. The reward will be divided among five winners who qualify by completing a series of simple tasks. To learn more about the airdrop, please visit the Wall Street Memes Discord.

Pros of Wall Street Memes:

- Experienced team and strong audience rooted in the 2021 GameStop bull run

- Raised over $100K within minutes of launching, indicating high interest and demand from the community

- Opportunity to purchase the token at a discount during the presale before it goes live on exchanges

- Represents a shift from the GameStop stock rally to crypto meme coins

- 30 rounds of the presale leading to a more sustainable price and potentially less volatility

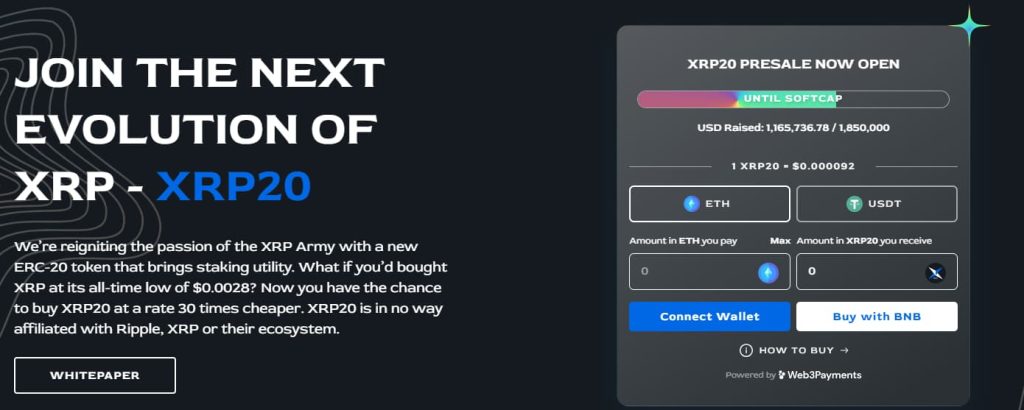

4. XRP20 – new stake-to-earn ERC-20 token

Leveraging the ERC-20 framework, XRP20 draws upon the legacy of its predecessor, aiming to provide a second chance to those who missed out on the meteoric ascent of $XRP. However, despite the similar name, XRP20 operates independently from $XRP and Ripple Labs.

A central advantage of XRP20 is the introduction of stake-to-earn rewards. Investors are granted the opportunity to stake their XRP20 tokens, contributing to transaction validation and network security, thereby receiving additional XRP20 tokens in return. This makes XRP20 a desirable choice for those seeking prolonged investment opportunities through staking.

Post-launch, a significant 10% of the total token supply will undergo burning, effectively decreasing the available token pool. Capitalizing on Ethereum’s capabilities, XRP20 ensures accessibility and user-friendliness for potential investors.

The ongoing presale opens the gateway for early investors to acquire $XRP20 tokens at an astonishingly low price of $0.000092, a fraction of $XRP’s historical low. The presale is expected to finish rather quickly, given the modest soft cap of $1.85 million.

The presale secures 40% of the total supply, underscoring the significance of early commitment. An equivalent 40% is reserved for the project’s staking pool—a pivotal aspect that enables token holders to garner passive income through token lockup.

Pros:

- Introduction of $XRP20 on a decentralized exchange (DEX) in the post-presale phase

- Clearly defined tokenomics

- Low token price during the presale stage

- Raised over $1 million within the first week of presale

- Stake-to-earn mechanics

5. IMPT

The use of digital assets has grown exponentially and every day, products like NFTs are being created on the blockchain. This can be incredibly damaging to the environment when considering carbon emissions, so the IMPT project has come up with a unique solution. IMPT is promoting a blockchain initiative that is tokenizing carbon credits to offer as NFTs to a more conscious audience, alongside a unique store and social media platform.

IMPT’s staff comprises a host of leaders with varying expertise – and as they are open about who they are, users are getting an unrivaled level of transparency.

Here are some of the advantages on offer:

- Over 10,000 leading companies already support IMPT’s efforts

- These NFTs are displayed in a decentralized ledger, so users can track them for ultimate transparency

- With the phase 1 pre-sale selling tokens for just $0.018, it could prove to be a worthwhile investment

6. WeSendit – Innovative File Transfer Platform

WeSendit (WSI) is another option to consider if you are looking to invest in an upcoming ICO with high-profit potential. Using web 3.0 technology, the developers created a secure, fast, and convenient platform users can use to share large files.

As of the time of writing this article, the platform has over 3.5 million users. One of the pros of WSI is that you earn WSI tokens when you use its premium service. The developers are planning to host a 15 million token airdrop soon, and we firmly believe those who key into this project early will make good profits.

Some of the highlights of WeSendit are:

- Innovative, convenient, and fast file transfer platform

- 3.5 million users from 150 countries

- Earn WSI tokens when you use its premium service

- High-profit potential for early investors

7. Tamadoge – one of the top meme coins

Tamadoge (TAMA) is a meme coin that stood out from the pack by offering users some utility and rewards. It is an NFT game where players climb the leaderboard by feeding, exercising, and breeding digital pets. You earn TAMA tokens every time you complete a challenge on the game and can exchange these tokens for real money.

The project had a successful presale in 2022. Early investors made about 2000% profit on their capital when the price of TAMA tokens hit an all-time high. Although the token’s value is presently down like other tokens in the market, we expect it to rise significantly again when the market’s bearish run ends.

Some of the highlights of Tamadoge are:

- Rated one of the top meme coins in 2022

- Early investors earned 2000% gains

- Meme coin that offers some utility and rewards

8. Kryptview (KVT) – leading research-to-earn platform

Kryptview is another ICO project created to solve real-life problems. According to its white paper, the platform will gather information about digital tokens from money sources, analyze them, and use its result to provide insights for crypto traders. Users who contribute to the ecosystem by submitting feedback on digital tokens will earn rewards on the platform.

With KVT, investors can get accurate information about digital assets before committing their hard-earned dollars. The ICO for Kryptview is expected to start in the first quarter of 2024. You can buy KVT using EUR and RNB. We believe now is the best time if you are looking to invest in this project.

Some of the highlights of Kryptview are:

- Provides accurate information about digital assets

- KVT makes it easier for users to research tokens

- Rewards users for sharing their assessment of each researched token

9. Battle Infinity – Popular play-to-earn fantasy sports platform

Battle Infinity (IBAT) is a play-to-earn gaming platform integrated with the metaverse world called the Battle Arena. Players worldwide can battle against one another and explore the metaverse’s beautiful virtual world.

There are several benefits to owning the IBAT token. First, you can use the platform’s staking feature to lock your tokens for some time and earn rewards. Second, you can swap the rewards you earn from Battle Infinity with other currencies or use them to purchase in the platform’s marketplace.

Third, investors in this project can participate in IBAT premier league, which is launching soon. With this league, you can build your team, battle with other users worldwide, and earn rewards.

Some of the highlights of Battle Infinity are:

- World’s first NFT-based fantasy game integrated with the metaverse

- Multiple ways to earn rewards

- Allows you to battle with other players worldwide

10. Oryen Network – a robust high-yield platform for investors

Last but not least on our list of our best upcoming ICOs to watch for in 2024 is Oryen Network. It is a fully automated staking platform that guarantees daily 90% APY on your investment. According to the project’s white paper, ORY tokens will be available for interested investors throughout the three presale phases.

Our experts expect the prices to increase at each stage as there is high demand for the token. The main features are its compounding abilities and fast payouts. The platform pays every 60 minutes, making it the staking platform with the highest return and fastest payout time in the market.

Some of the highlights of Oryen Network are:

- Fully-automated staking platform

- Pays investors every 60 minutes

- The price is currently $0.335 and will be $0.50 at its launch

What is an ICO?

Initial Coin Offering (ICO) is a popular method that blockchain-based companies use to raise capital for their crypto projects. It works like Initial Public Offerings (IPO), where public limited companies raise capital for their business by offering shares to investors. However, in the case of ICOs, the company offers digital tokens, not shares.

The advantage of ICOs for investors is that they can acquire the tokens at a low price and make very high returns if the project turns out successful. For example, Ethereum was less than $1 per token during its presale phase. Today, Ethereum is worth over $1,200.

How do crypto ICOs work?

When a blockchain-based company decides to raise capital by selling tokens, it starts by setting a date for the ICO and determining the goal it wants to achieve. Then the company announces the information. Once the ICO starts, the process usually involves the following:

- Interested investors visit the project’s official website to find more information about the ICO and decide whether they want to invest.

- The website displays the token’s price and provides a crypto wallet for investors to make payments. You can make payments for most ICOs using ETH, BNB, and USDT.

- Once you pay for the number of tokens you want and you submit your wallet, the platform will credit your digital tokens to your wallet.

How to find the best upcoming ICOs?

There are two main places we recommend checking if you are looking at investing in upcoming ICOs but don’t know how to get started. First, you can check CoinMarketCap. This website provides updated information about upcoming ICOs, including their presale dates, price, cap, etc. Second, interested investors can check social platforms like Twitter and Reddit. Most companies make their ICO announcement on these platforms. One of the launches that is expected to be one of the biggest crypto presales of 2024 is AIDoge, a meme-generation platform.

However, please note that not all upcoming ICOs succeed. Like other crypto investments, ICOs are also risky. Some companies even start ICOs to scam investors. Hence, we recommend researching extensively before deciding whether to invest in an ICO. epic 電子タバコ emili リキッド for sale a great deal more delightful.

The good news is that we have done the leg work by bringing you ten upcoming ICOs with the highest profit potential in 2024. So you can get started with any of the ICOs on our list. Be assured that we only recommend ICOs after our experts must have scrutinized the project, examined its white paper, and investigated the team behind the project to confirm its authenticity and profit potential.

Benefits of investing in crypto ICOs

So now that you know what ICO is, how it works, and where to find them, let’s walk you through some of its benefits.

- The main advantage of investing in crypto ICOs is the opportunity to buy the tokens at the lowest price and earn a high return when the price increases. Some investors have made 100%, 200%, or more gains on their tokens within days of their ICOs.

- The top upcoming ICOs allow investors earn passive income. While some allow you to earn rewards via staking, others pay you interest on your holdings.

- All the ICOs on our list offer some form of utility. For instance, FightOut rewards you for working out, and Dash2Trade tokens give you access to its crypto analytical platform.

Bottom Line

Crypto ICOs earned investors significant profit in 2022, and there is potential for higher returns in 2024. However, the challenge most investors have is how to spot profitable upcoming ICOs. In this article, we shared our top ten picks for the best upcoming crypto ICOs so you can get started right away. We recommend investing in these projects because they have great profit potential and offer users some utility.

Frequently asked questions about crypto ICOs

What are the best upcoming ICOs to watch for in 2024?

After thorough research, our picks for best ICOs in 2024 are Bitoin ETF Token, Bitcoin Minetrix, FightOut, Dash2Trade, RobotEra, Lucky Block, WeSendit, Tamadoge, Kyrptview, IMPT, Battle Infinity, and Oryen Network.

Are crypto ICOs good investments?

Yes, you can earn above-average returns when you invest in crypto ICOs. However, you should research extensively before investing in any ICO to avoid committing your money to projects that are not viable.

How do I invest in crypto ICO?

You can invest in crypto ICOs by clicking on any of the projects we listed. This will take you to the project’s official website, where you can get more information and buy the tokens you want.